Your Legacy, Your Public Media

YOUR LEGACY

YOUR PUBLIC MEDIA

Shape TPT’s Future

YOUR LEGACY

YOUR PUBLIC MEDIA

Shape TPT’s Future

Build a lasting legacy and preserve Twin Cities PBS for generations to come.

Your gifts, whether made during your lifetime or through your estate, will demonstrate your belief in and support of TPT’s mission to: enrich lives and strengthen our communities through the power of public media.

Benefits of including TPT in your estate plan

- Preserves savings and cash flow for lifetime needs

- Can be changed or revoked at any time

- Potentially allows you to be far more generous than you thought possible

GIFT PLANNING ASSISTANCE AT TPT

The Development Office stands ready to partner with you and your advisors over your lifetime to help explore gift planning options that are most appropriate for you.

If you have questions or would like to learn more about your estate and gift planning options, please contact us at 651-229-1410 or [email protected].

A simple paragraph or change to beneficiary designation is all it takes

Sample Bequest Language for Wills & Trusts:

I give and devise to Twin Cities Public Television, Inc., a not-for-profit corporation of the state of Minnesota, _________percent of my estate (or the residue of my estate; or the sum of $_____; or the properties, securities, etc. described herein) to be used for its unrestricted purposes or for its endowment.

Full Legal Name: Twin Cities Public Television, Inc.

Federal Tax I.D: 41-0769851

Address: 172 E. 4th Street, St. Paul, MN 55101

|

THE IMPORTANCE OF ESTATE PLANNING

|

Estate planning is an important process that can help protect you, your family, and your assets. Estate planning is one of the most overlooked areas of personal financial management. It is estimated that over 50% of American’s do not have an estate plan. Many mistakenly believe that this process is for the wealthy or the retired, but estate planning is for everyone!

Proper estate planning saves you and your loved ones money, passes your assets in the way you desire, provides health direction when necessary, determines care for your children, and provides peace of mind. Following life- changing events, estate plans should be reviewed to ensure they still meet your needs, goals and objectives.

THE IMPORTANCE OF CHARITABLE GIFT PLANNING

Charitable giving is an important consideration during estate planning. Current and estate gifts to TPT create both a living and a lasting legacy. Your generosity demonstrates what you value, as well as what you want to preserve for your children, grandchildren, and future generations.

Whether you are giving during your lifetime or through your estate, many options are available to help you reduce or eliminate income, capital gain, and estate taxes. It can also allow the continued use of a donated property during your lifetime or return the principal to you or your heirs after a number of years.

GIFT PLANNING OPTIONS

Assets to Consider When Planning Your Charitable Gift

* Cash – U.S. currency, certificates of deposit, or cash from your donor advised fund

* Securities – appreciated and publicly traded stocks, bonds, and mutual funds

* IRA and Retirement Plans – required minimum distributions and beneficiary designations * Personal Property – autos, art, collections, and precious metals

* Real Estate – businesses, homes, and farms

Easy and Tax-Smart Planning Methods

* Will or Revocable Trust – the most frequently used methods for making estate gifts to charity (specific amount or item of property or all or a percentage of the residue of the estate)

* Beneficiary Designations – increasingly used, especially with retirement accounts, because it may be done without changing a will or trust and because of potential income tax savings (retirement accounts, stock and investment accounts, and bank accounts)

Benefit Returning Gift Options

* Return of Income for Life – consider Charitable Gift Annuities and Charitable Remainder Trusts * Return of Principal After Period of Years – consider a Charitable Lead Trust

* Retain Use of Real Estate for Your Lifetime – consider a Retained Life Estate

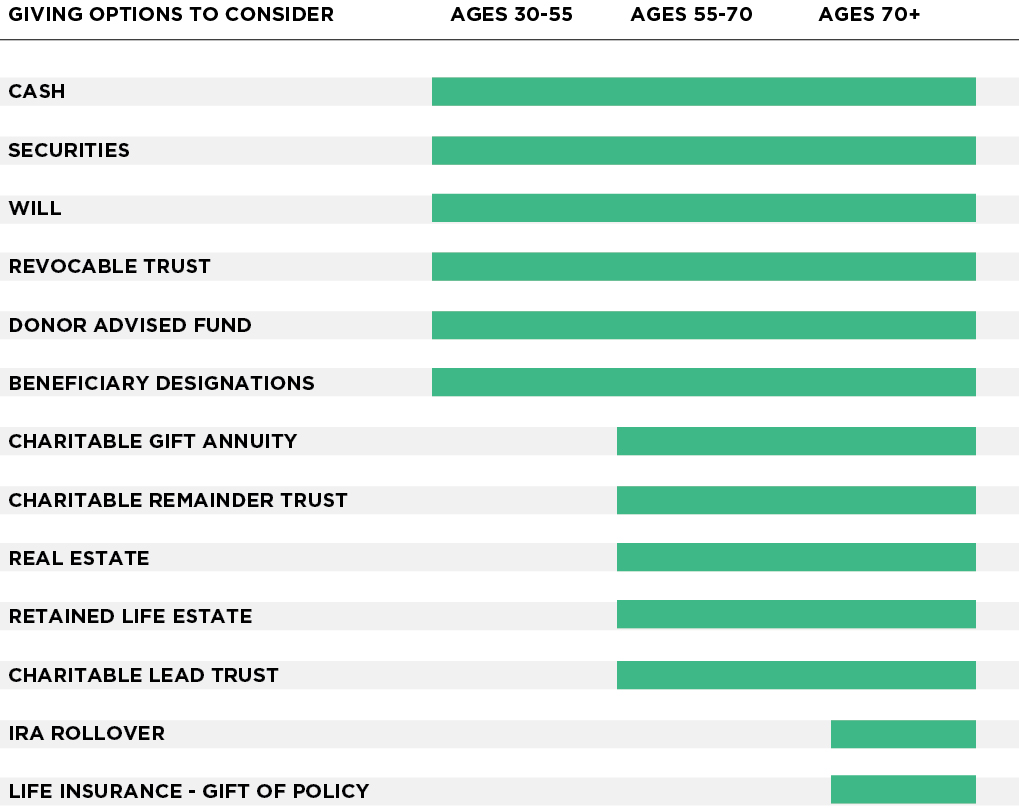

LIFE STAGE GIVING OPTIONS

Charitable giving happens over a lifetime. As we age, additional giving options may be appropriate and worth considering.

YOUR CONTRIBUTIONS HELP US CONTINUE TPT’S 60-YEAR LEGACY OF PUBLIC TRUST

© 2024 Twin Cities Public Television