photo by Adobe Stock

By Richard Eisenberg | Money & Work Editor | Next Avenue

Many millennials are having a tough time financially launching their adult lives and careers, what with the high cost of rent, student loans and health care, plus unreliable gig-economy income. So it’s no surprise that many of their boomer and Gen X parents are offering financial support. But what may surprise you is how much support the parents are providing: $500 billion annually, according to a new estimate from Merrill Lynch and Age Wave, which is a thought leader on aging and its implications.

In their new study, The Financial Journey of Modern Parenting: Joy, Complexity and Sacrifice, Merrill Lynch and Age Wave call this chunk of change “the hidden economy of support.” Said Ken Dychtwald, CEO and founder of Age Wave: “We were floored by what we found.”

Support Your Adult Child or Your Retirement?

To put the $500 billion price tag in perspective, by Merrill Lynch’s and Age Wave’s reckoning, it works out to twice the amount that parents of adult children are putting into their own retirement accounts. Which raises the question: Are boomer and Gen X parents being too generous and harming their own retirement prospects?

Quite possibly.

“Parents are providing so much money! And these are the same parents who are struggling to save enough to do caregiving for their moms and to pay for their own retirement,” said Dychtwald.

Putting Kids’ Interests First

In the Merrill Lynch Age Wave survey of more than 2,500 parents which spawned the financial support estimate, 72 percent of the parents said they’ve put their children’s interests ahead of their own need to save for retirement. And 63 percent report having sacrificed their financial security for the sake of their children. What’s more, roughly a quarter of parents said they’d be willing to take on debt and pull money from their retirement accounts to support their grown kids. (The researchers also surveyed 500+ teenagers to hear what they had to say.)

If you’re thinking the $500 billion in support is just due to the roughly 31 percent of early adults age 18 to 34 who’ve boomeranged back home to live with their parents, think again. Dan Veto, an Age Wave senior adviser who worked on the study, said only about $100 billion — or 20 percent of the annual parental support — is attributable to boomerangs.

In fact, the study maintains, 79 percent of parents are providing financial support to their adult children. “And not just a little; the average was $7,000 a year,” said Dychtwald. Merrill Lynch and Age Wave call this the “family bank.”

Where the Money Goes

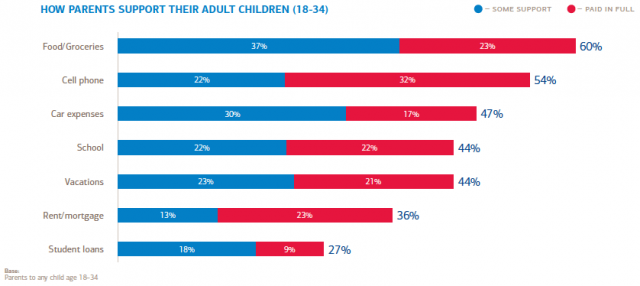

As the chart below shows, the support ranges from paying for food and groceries (provided by 60 percent of parents of kids 18 to 34) to repaying the kids’ student loans (27 percent of parents). The researchers also estimate parents are paying their children’s cell phone bills to the tune of $18 billion a year; I’m guilty of this.

The $500 billion figure — Dychtwald called it “the invisible trade imbalance” — may actually be a conservative estimate.

“There might also be special expenses providing assistance, such as for the down payment of a home or a wedding,” said Surya Kolluri, a managing director in the Retirement and Personal Wealth Solutions group at Bank of America Merrill Lynch. “The expenses in the $500 billion estimate are for regular ordinary support.”

The Empty Nester Myth

If your kids haven’t yet finished college or left home, don’t blithely assume you’ll suddenly find yourself flush with extra cash after they move out and you join the 48 million empty nest households in America.

“There’s a notion that once you become an empty nester, your spending will go down automatically,” said Kolluri. This new study shows that it often doesn’t.

Do the kids need the money the parents are bestowing?

“We’re not really sure,” said Dychtwald. “When we see that 79 percent are providing support to their kids, it seems like it’s become sort of standard. We imagine that it’s a combination of the parents’ not wanting their kids to struggle and not having the kids appear to be doing less well than other young people.”

What’s a Parent to Do?

So what’s a well-meaning parent to do?

Every situation is different, of course, so it’s impossible to offer a rule on how much to assist your adult children or even how. “There is no guidebook,” noted Dychtwald.

But what boomer and Gen X parents can do is assess their own money status and project their financial future in retirement. Then, they can have candid conversations with their grown kids about what’s possible and what’s not.

“’What’ and ‘how much’ are the two variables,” said Kolluri, speaking like the former engineer and MBA he is. “Look across all categories — groceries, cars, vacations, rent, cell phones — and prioritize.” Ask yourself, Kolluri said, “What do I rationally want to support and how much do I want to support it?”

That may be a new question for many. In the Merrill Lynch Age Wave survey, said Dychtwald, “parents realized they didn’t know how to execute boundaries or when to say ‘enough is enough.’ This is new, uncharted territory for them.”

What Teens Say Parents Haven’t Done

When you do have the financial conversations with your grown kids, be sure to pass along the basics of investing, too.

The Merrill Lynch Age Wave study found that many parents think they’ve explained investing already, but their kids disagree. Only 31 percent of the teens surveyed said their parents taught them to “invest early and benefit from compounding.” But 59 percent of the parents said they passed this information on to their kids.

For advice on helping pay your child’s college without endangering your retirement, check out the new, useful website from personal finance expert Beth Kobliner, We Need to Talk: College. I just wrote about it for Next Avenue, interviewing Kobliner to hear her tips.

A Financial Adviser Might Be a Buffer

Just don’t stop saving for retirement to give your kids the money you would’ve put toward your future.

“I worry that we’ve got all these 40-, 50- and 60-year-olds subsidizing their children for thousands of dollars year after year. That’s going to come back to haunt them; it’s not going to make their future more secure,” said Dychtwald.

You may also want to make an appointment with a financial adviser, perhaps with your grown child in tow. Such two-generation meetings are “increasingly common,” said Kolluri.

Sometimes it helps to have a neutral third party to lay down financial guidelines for a family.

![]() This article originally appeared on Next Avenue

This article originally appeared on Next Avenue

© Twin Cities Public Television - 2018. All rights reserved.

Read Next