By Katie Moritz | Rewire

We’ve talked about the benefits of buying a home. But although homeownership is a goal for a lot of people, it’s not possible for everyone. According to MarketWatch, half of U.S. families live paycheck to paycheck—while they might be able to make rent each month, socking away money for a big cost like a downpayment isn’t possible.

And in every state, even rent is getting tougher and tougher to pay. For many, their wages just can’t cover rising costs of rental housing.

And in every state, even rent is getting tougher and tougher to pay. For many, their wages just can’t cover rising costs of rental housing.

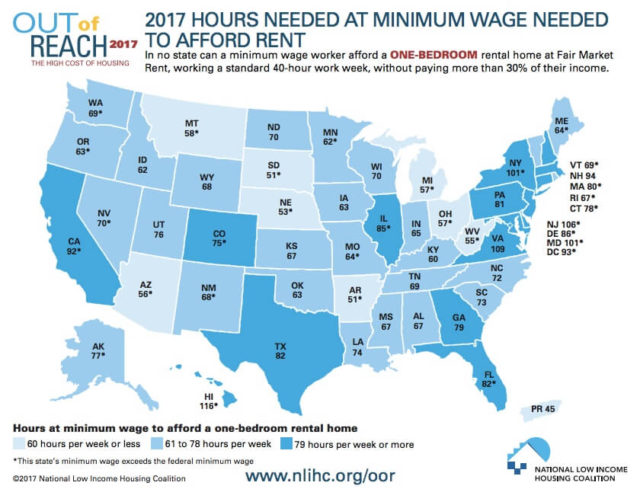

A new report by the National Low Income Housing Coalition shows that there’s no state in the country where renters can work 40 hours a week earning the prevailing minimum wage and afford a two-bedroom rental home. A worker earning the federal minimum wage of $7.25 per hour would have to work 117 hours per week to afford a two-bedroom place and 94.5 hours per week to afford a one-bedroom. (Some states’ minimum wages are higher than the federal minimum wage.)

In only 12 counties in the entire country can a full-time worker earning the prevailing minimum wage afford a one-bedroom place without spending more than 30 percent of their income. A household is considered cost-burdened if more than 30 percent of its income is spent on rent, according to the Minnesota Housing Partnership.

On average, a renter in the U.S. needs to earn $21.21 an hour, or more than $44,000 per year before taxes, to afford a modest two-bedroom rental home, and $17.14 per hour to afford a one-bedroom place, according to the NLIHC’s report. Both are more than double the federal minimum wage and more than the average hourly wage of $16.38 earned by the country’s renters. (You can find detailed information about your area here.)

Pushed out with few options

Why has the rental landscape gotten so tough for minimum wage earners? An increased demand in rental housing across the country has shrunk the vacancy rate from 9.8 percent in 2006 to 6.9 percent in 2016, according to U.S. Census information. During that time, the Consumer Price Index for rental cost rose almost 32 percent because of the growing supply and demand discrepancy.

But average household income hasn’t been rising at the same rate.

But average household income hasn’t been rising at the same rate.

“From the housing crisis of 2007 to 2015, the median gross rent for a rental home in the U.S. increased by 6 percent, after adjusting for overall inflation, while the median income for renter households rose by just 1 percent and median income for all households declined by 4 percent,” the NLIHC’s report states. “The U.S. has 7.5 million affordable rental homes for the 11.4 million extremely low income renter households.”

Those numbers are a recipe for disaster for many of the country’s workers. And in many cases, higher income workers are pushing those earning a lower income out of the most affordable rental housing.

“In the private market, the poorest renters compete with higher income households for rental homes,” the report states. “Three and half million rental homes affordable to extremely low income households are unavailable to them because they are occupied by households of higher income. As a result, only 4 million affordable and available rental homes exist for the 11.4 million extremely low income renter households, leaving a shortage of 7.4 million.”

More housing desperately needed

Thankfully, new rental home construction is on the rise. According to Harvard University’s Joint Center for Housing Studies, new construction projects launched in 2015 had reached the highest levels since the 1980s. The center predicts an additional 4.7 million rental properties added to the market by 2025.

Unfortunately, this could not be enough to help low-income renters, according to the NLIHC. The typical low-income renter can’t afford new construction, with the average rent for brand new apartments at $1,381 per month in 2015.

Learn more about the rental housing crisis in the U.S.:

Watch the full “Sold Out” documentary

![]() This article originally appeared on Rewire

This article originally appeared on Rewire

© Twin Cities Public Television - 2017. All rights reserved.

Read Next